Rising acquisition costs are a danger to the profitability of many business-to-business (B2B) enterprises, even though these organizations need new customers. Across all industries, CAC has increased by 50% or more over the last five years, meaning that every new client spends more on sales and marketing.

In a typical 100-500-person organization, 7 people make most purchase decisions, according to Gartner Group. That means without any effort, you can not make the maximum number of people repetitive, which will increase your CAC when you spend on your new customer.

But what can B2B marketers do to minimize CAC and deliberately grow market share?

Optimizing each CAC equation component maximizes conversion efficiency and customer value at every phase. To build loyalty and improve target account selection, lead generation, sales productivity, and customer experiences. Successful CAC reduction balances growth with economic restraint.

Increase sales efficiency by 15-25%, quadruple client lifetime value through retention, cut cost per lead through prospecting, and more. Cutting client expenses can help B2B marketers gain market share and outperform competitors with unsustainable CAC.

This article will discuss strategic CAC Reduction for B2B business

What is Customer Acquisition Cost (CAC)?

A company’s expenditure in acquiring new customers is known as its customer acquisition cost. CAC is a crucial growth indicator for companies to gauge sales efficiency and customers’ profitability.

Customer acquisition costs are high, and failing to manage customer acquisition costs is like trying to descend Yosemite without a harness.

If your business strategy is successful, your CAC will be lower than LTV. Then, there is no problem. CAC is like a seesaw; it could go up and down. You can put your SaaS company on the upswing with the data and instructions we will provide.

Why should B2B marketers take CAC Seriously?

According to a recent poll of B2B marketing executives, the goal of B2B marketers is to demonstrate the contribution of their departments to pipeline and revenue by examining more granular analytics.

Taking a deeper look at analytics became a priority for most respondents (62%), who wanted to prove the impact of marketing. Another interesting finding is that over half of the marketers surveyed (54%) expressed a desire to place greater emphasis on demonstrating the return on investment (ROI) of marketing budgets.

68% of B2B marketers wanted to understand CAC better, while 58% ranked ROI by channel as the most critical indicator to investigate further, along with ABM metrics, closed-won deal analysis, cross-channel engagement, customer lifetime value, and cross-channel attribution.

Here are some reasons why CAC is essential for a B2B business-

Improve Business Decision-Making

Knowing your CAC can help you make better business decisions in the future by providing you with important information. You may optimize your expenditure and save money by gaining insight into the effectiveness of your marketing activities through the information you gather. With this data, you can make informed decisions regarding customer acquisition while keeping costs minimal.

Provide a Clearer Picture of How Sales and Marketing Work

Knowing your CAC lets you see how well your sales and marketing teams are doing. If your marketing and sales budget is insufficient, you risk losing out on potential new clients who need your product or service. The inverse is also true: you will only profit if you spend less on advertising. When you calculate the customer acquisition cost, these instances are brought to light, allowing you to allocate budget money more wisely.

Develop a Better View of Things

Finding your CAC may show something after some time. But when you add other important metrics, the bigger picture will appear. Among the most critical indicators to compare with CAC is the customer lifetime value (LTV).

Customer profitability can be found by comparing LTV to CAC. The LTV/CAC ratio shows the amount of money you need to earn from a customer to cover the cost of acquiring them. It could take a while to recoup expenses and produce a profit, particularly for software as service businesses. You may maximize your return on investment (ROI) by striking the correct balance.

Critical Factors to Consider Before Implementing Reduction Strategies

Unfortunately, it is essential to remember that there are limitations to any statistic. Therefore, let’s think about the significant disclaimers before plunging headfirst into getting your CAC down:

Earnings Potential

You will not be able to fully appreciate the effort that went into winning over those clients if you attempt to rush things. If you drag out the process for too long, you will not be able to see changes in strategy or organization. Consequently, CAC is irrelevant today.

As you can see in the guide below, it is best if you have access to the most recent Time to Revenue data. If you follow these steps, you can be sure your Customer Acquisition Cost will be accurate.

Diversity in customer base

Due to statistical consistency, the Customer Acquisition Cost metric needs to be improved to assess the unique characteristics of your clientele. In principle, a higher CAC may be justified for more valuable consumers. Since these channels may generate high-revenue clients, removing them due to high CAC could hurt revenue. Therefore, using LTV while optimizing activities using CAC as a benchmark is critical. After that, money can be considered.

Dividing your customers into smaller segments unveils the intricate dynamics between CAC and LTV across different groups. This invaluable knowledge empowers you to grasp the precise expenditure required to acquire each distinct advantage, enabling you to allocate your investments strategically.

Consequently, this process enhances your comprehension of your ICP (Ideal Customer Profile) using the CAC metric.

Practical Strategic CAC Reduction for B2B Business

- Determine the average length of your customer’s journey

- Increase Your Retention Rate

- Offer Personalization

- Automate Your Business Activities

- Provide Reliable Benefits

- Take the Initiative to offer a Loyalty Program

- Fine-Tune your Price Plan

Step 1: Determine the average length of your customer’s journey

Potential customers’ interactions with your brand can be better planned using a “customer” or “buyer” journey. Simply put, it’s about viewing your marketing campaigns through the eyes of your target audience. This way, strategists can better understand their audience, find ways to engage them, and ultimately boost sales.

Keap reports that organizations that improve customer experience see a 42% boost in customer retention, 33% in customer satisfaction, and 32% in cross-selling and up-selling.

You can learn the specifics of each consumer interaction by piecing together their journey with your brand across all touchpoints. Your company’s growth depends on your familiarity with these touchpoints and your ability to direct your audience to positive customer experiences at each one.

Determine your average time to revenue or the length it takes from the initial point of contact to the closing of a contract before you can calculate your CAC.

Months to recover CAC = CAC/ (Average monthly payment * Gross margin %)

This is the formula for calculating CAC.

Step 2: Increase Your Retention Rate

If you can make your customers recurring or repetitive, you can quickly decrease the CAC of your B2B business. B2B e-commerce CAC can drop dramatically by increasing retention. Retained customers are more valuable over time, have lower churn, have lower repeat purchase costs, and act as referral sources, lowering CAC.

In particular, long-term recurring clients spend more than new ones. Engaging clients for longer times increases their lifetime value to the company. Acquiring them pays off more through their continued business. Also, better retention rates reduce churn. Fewer hard-won clients leave, improving the return on CAC spent to acquire them. Simply put, less churn improves sales and marketing ROI.

Repeat business is cheaper than new business. Higher retention rates mean more recurrent, lower-cost client interactions. Finally, satisfied return customers are most likely to recommend your B2B firm. A broader base of retained customers provides more referral potential to lower CAC since referral clients usually have low acquisition costs. Longer customer retention enhances lifetime value, lowers churn and replacement costs, promotes repeat business at lower marketing expenditures, and improves referral rates, reducing CAC over time. To maximize value per customer, B2B e-commerce players must focus on retention.

Step 3: Offer Personalization

Using personalization to your advantage is an excellent method to reduce customer acquisition costs (CAC) and boost lifetime value for current customers. Research shows that 79% of consumers are willing to divulge some personally identifiable information in exchange for more personalized and contextual brand interactions.

An emotional connection between your B2B business and your new and existing clients may be formed by providing them with a personalized experience.

Another strategy is to keep customers coming back with product personalization. Product personalization can be offered with a third-party product personalizer.

If you are a businessman at Shopify, you can easily use product personalizer in your store, because thousands of apps are available at the Shopify app store. Choose your preferred one.

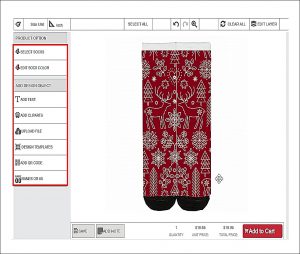

Here, with the help of a product personalizer, users can design their Christmas-themed socks.

However, remember that you may raise the possibilities of repeat sales and the average customer lifespan by dividing your purchasers into distinct segments and giving each element personalized emails or offers depending on their likes.

Step 4: Automate Your Business Activities

As a B2B wholesaler, you know that your customers’ time is precious to them. Because bulk buyers are busy developing their businesses, they do not have extra time to invest in communication, buying products with back-and-forth processes, or doing marketing manually.

When you are a B2B wholesaler, try to save your customers time by making everything automated so that when you are unavailable, your integrated tool can do the rest in your absence.

For example, you are a Shopify B2B wholesaler, selling products in Bulk with a third-party quick order app. This app will save your customers valuable time and let them do their other tasks properly.

Though it is not a fully automated app, it will still reduce the need for back-and-forth ordering. And make the wholesale ordering process automated.

The Shopify app store has several bundles, such as MOQ and one-click add-to-cart apps. As a business owner, think smartly and choose a versatile app that combines all these things. Because these are the things that will make your customers loyal to your business, and loyal customers mean low CAC.

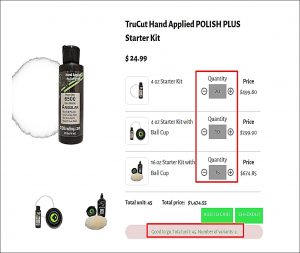

Let’s have a look at a bulk order app for Shopify-

Here, the wholesaler is selling polish kits in bulk. In this picture, a buyer has chosen 45 products, and this app offers a one-click add-to-cart. Another exciting thing about this is that this app allows you to select multiple variants from one product page, which is impossible at Shopify by default. In this sense, this app automates adding bulk products to the cart process.

This is an example of a wholesale app for Shopify. In the same way, there are email marketing automation tools, subscription tools, SEO tools, and competitor analysis tools. You can choose any tools that go well for your business. To make your business thoroughly and semi-automated.

Step 5: Provide Reliable Benefits

The initial stride toward customer retention is encouraging clients to perceive substantial value in their association with your brand. Selling tangible goods and services to your target market is one of many ways to do this. This implies that you should consider additional strategies to assist your target audience.

Consider the typical steps a consumer takes while dealing with your e-commerce site. How can you simplify it, make it more interesting, and work better? For example, in addition to making purchases, many people use the web to find helpful information.

Providing instructional content alongside advertisements is a great way to diversify your content marketing strategy. Relationships are strengthened when a marketing channel, such as a blog, is transformed into a resource people can use to enhance and simplify their lives.

Take an eCommerce brand that sells shoes and clothes as an example. You could write material about how to dress for various occasions or show your current customers how to mix and match shoes with different clothes to create new looks.

Increase your value in the eyes of your customers and bring in new clients by utilizing your content marketing platforms in this way. By optimizing your blog for search engines, you can raise your search engine rankings and lower your pay-per-click ad spending.

Step 6: Take the Initiative to offer a Loyalty Program

Incentivizing current clients to remain loyal is another excellent strategy to reduce customer acquisition costs.

Most consumers (around 75 percent) prefer to do business with organizations that offer incentives.

Considering this, consider what would keep your eCommerce customers coming back.

A loyalty program can be built in various ways. You might offer your consumers a tiered “point” system where they earn points for each purchase or action they do with you. Clients will be more loyal to your company than a competitor if they can receive valuable rewards; after all, they won’t want to lose what they’ve invested in.

Making your most loyal consumers your brand’s champions through a referral program is another viable choice. You may improve your marketing strategy and get clients for free by doing this. Give out free delivery, a discount, or a present to customers who bring in new customers whenever you can.

In addition to increasing consumer loyalty, referral programs can boost prospects for word-of-mouth marketing.

Step 7- Fine-Tune your Price Plan

Optimization of pricing in B2B e-commerce has the potential to yield significant reductions in client acquisition costs, commonly referred to as CAC.

The most effective approach to pricing strategy is one that aims to maximize the lifetime value of clients while simultaneously attracting new customers through the implementation of affordable pricing structures.

By employing tiered pricing models and customer segmentation techniques, companies can optimize their pricing strategies to cater to both budget-conscious individuals as well as those seeking a premium experience.

Establishing an optimal pricing structure is imperative to set a baseline price that maximizes long-term value. This requires a thorough understanding of how much customers are willing to pay, which can be determined through careful price planning.

To get new customers, you need to find a good mix between making money in the long term and giving them incentives like discounts or cheaper starter sets when they first start doing business with you.

Customers can also start at lower prices and move up with tiered pricing. This makes the market more open for people who need cheaper jumping methods. Lastly, dividing customers into groups based on their business, size, etc., lets price-conscious accounts get lower prices while premium tiers pay more.

Strategic pricing increases the addressable market for new businesses without reducing long-term earnings. Low initial charges attract clients while tiering and segmentation keep high-value accounts profitable.

To save acquisition efforts on unsuitable prospects, it’s best to avoid a one-size-fits-all approach and instead focus on converting consumers.

B2B e-commerce players must refine pricing to balance growth, profitability, and CAC per new customer.

Bottom Line

As competition rises and customers change, B2B marketers are pressured to lower the costs of getting new customers. Business-to-business marketers can use these tactics to save money and improve cost-benefit analysis.

Conversion, client lifetime value, and brand loyalty rise. These tactics improve B2B marketers’ efficiency and efficacy.