Why do some B2B stores grow faster and still keep their pricing fair? One big reason: dynamic pricing.

Static pricing might feel easier, but in today’s world, it’s holding you back. Costs shift fast, and demand changes. Customers expect personalized deals, not a one-size-fits-all number.

That’s where dynamic pricing comes in.

It lets you adjust prices based on real situations, like order volume, stock levels, or who the buyer is. And it works. Studies show companies using dynamic pricing can see a 4 to 8 percent margin boost.

If you run a Shopify store and serve B2B customers, it’s time to rethink your pricing model. In this guide, we’ll break down what it means, how to know if you’re ready, and which strategies help the most.

Table of Contents

What is Dynamic Pricing?

Dynamic pricing means your prices can change based on certain conditions. These could be order size, customer type, stock levels, or time of day. You set the rules, and prices adjust automatically.

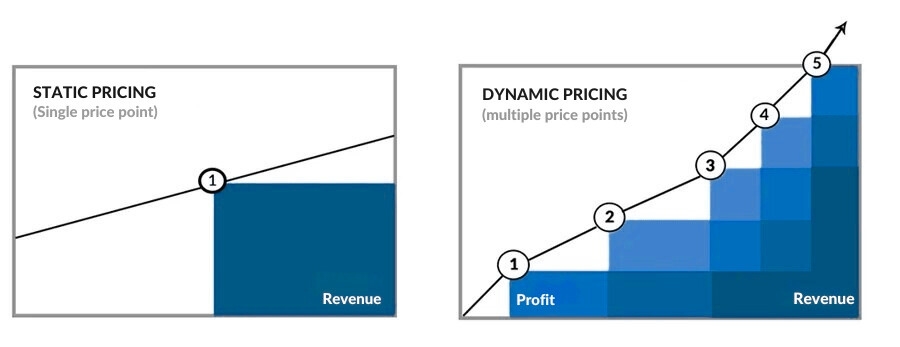

Static pricing means using one fixed price for everyone. It doesn’t change with demand or customer type. When you adopt it, you miss out on extra profit by not adjusting. Dynamic pricing uses many different prices. This helps businesses make more money. It’s more flexible and helps increase both profit and revenue.

In B2B, it’s not about giving random discounts. It’s about matching your prices to real situations, like offering better rates for bulk buyers or updating prices when costs go up.

This helps you stay flexible without changing prices manually every time. It also makes it easier to serve different types of customers fairly.

And yes, you can do it on Shopify. You just need the right setup.

Real-World Examples of Successful B2B Pricing

Dynamic pricing isn’t a theory. It’s already in play and working. Here’s what it looks like in the real world.

- Amazon Web Services

Not everyone needs the same thing. AWS gets that. So instead of locking you into a plan, they bill you based on usage. If your demand increases, so does your bill. It’s clean, flexible, and hard not to like.

- Uber Freight

Trucks aren’t always where you need them. Uber uses live data – availability, urgency, and miles- to adjust pricing. It feels less like quoting and more like matching.

- Chemical Suppliers

Instead of chasing spreadsheets, some suppliers plug into raw material indexes. When base costs shift, their product prices follow. It’s logical. And it builds trust.

- Machinery Parts

Inventory isn’t just a number; it’s a signal. Do you have too much stock? Drop the price. Running low on inventory? Increase it slightly. One distributor set simple rules and let the system do the nudging.

- Dell

Dell trimmed the dead time. Now quotes adapt based on who you are, what you’re buying, and past deals. It decreases the waiting period.

- Salesforce

This customer relationship management (CRM) platform uses dynamic pricing to offer businesses a range of pricing plans based on the level of functionality and usage.

Why do B2B Merchants Need Dynamic Pricing?

B2B stores deal with more moving parts than most. Prices aren’t just about markups. They’re tied to cost, supply, shipping, and customer terms. But most merchants still use static pricing: one price for everyone, even when conditions change.

That’s a problem.

When raw material costs rise, you lose margin. When stock runs low, you can’t slow sales without editing prices manually. If a buyer places a big order, you want to reward that, but static pricing won’t let you.

You also lose time. Every custom quote means emails, approvals, and back-and-forth. Meanwhile, your competitor sends a smart price in seconds and gets the sale.

Dynamic pricing solves these pain points.

You set rules. The system updates prices for you based on order size, stock levels, customer type, or location. It’s not about discounts. It’s about staying aligned with what’s happening in your business.

This approach also feels fair. Buyers understand why prices change. You protect your margins without chasing every change by hand.

Dynamic Pricing Maturity Curve

Not every store is ready right away. Most grow into it. Here’s how that journey usually looks.

Stage 1: Static Pricing

This is where most small B2B stores begin. You sell a few products, so one fixed price feels simple and easy to manage. But as your costs change or product lines grow, this approach starts to hurt. You can’t respond to rising expenses or big orders without editing things manually, and that gets messy fast.

Stage 2: Tiered Pricing

Once you start selling to different types of customers, wholesalers, resellers, or repeat buyers, you need more control. Tiered pricing lets you offer different price levels to different groups. It’s better than static pricing, but it still doesn’t react to what’s happening right now. It’s not built for changing demand or real-time updates.

Stage 3: Rule-Based Pricing

At this point, you’re doing more volume and need automation. You set up pricing rules – like 10% off for orders over 100 units, or higher prices when stock runs low. This works well for mid-sized merchants. But once your wholesale product catalog or customer types get more complex, managing all those rules becomes a full-time job.

Stage 4: Adaptive Pricing

This is for advanced stores using AI and automation. Prices adjust on their own based on behavior, demand, or competitor pricing. It’s powerful, but risky if not explained clearly. If buyers don’t understand why a price changed, they’ll lose trust. And trust is everything in B2B.

How do You Know if Your Store is Ready for Dynamic Pricing?

Dynamic pricing isn’t suitable for every store right away. However, if you’re feeling stuck with how you handle prices, it’s worth considering.

First, look at your products. If you sell only a few items, sticking to one price might be acceptable. However, once you have different sizes, colors, or materials, and your costs fluctuate, it becomes more complicated. Manually changing prices takes time and can eat into your profits.

Next, think about your customers. Do you sell to different groups, such as wholesalers and retailers? If everyone pays the same price, you’re likely missing opportunities to earn more. If you already offer different prices but spend a lot of time updating them, this pricing system could alleviate that burden.

Then, consider your market. Do your supply costs change frequently? Shipping delays or fluctuations in raw material prices can impact your business. If your prices don’t add just to these changes, your profits will suffer. It helps you stay on top of these changes.

Also, examine your sales. Do you sell large orders or subscriptions? Do some items sell out quickly while others accumulate? Flexible pricing can help manage your stock better and keep your customers satisfied.

Lastly, assess your tools. If you’re using Shopify apps or software to track inventory or customers, you’re closer to implementing this pricing system without added hassle.

9 Proven Dynamic Pricing Models for Shopify B2B Merchants

If you’re a B2B brand on Shopify, chances are your buyers aren’t all the same. Some buy in bulk, some come back often, and some care more about timing or service than price. That’s where dynamic pricing helps. It lets you adapt prices based on real context, not just guesswork.

Below are 9 proven pricing models that work especially well for Shopify B2B stores. Each model offers a different way to stay competitive, protect margins, and serve customers fairly without manual updates every week.

| Pricing Model | How it Works |

|---|---|

| Time-Based | Price shift during peak times or seasons. Great for fast-moving goods or limited-time promos. |

| Quantity-Based | Bigger orders get better rates. This encourages bulk buying without needing custom quotes. |

| Tiered Pricing | Set price levels by order size or contract terms. Works well with Shopify’s price lists. |

| Negotiation-Based | Sales reps adjust pricing based on deal talks. Can be tracked with tagging or custom fields |

| Market-Based | Prices follow real-time market trends. Useful for raw materials or high-volatility products. |

| Contract-Based | Locked-in pricing for specific accounts. Reduces confusion and keeps deals consistent. |

| Segment-Based | Different segments (wholesale, retail, VIPs) get different pricing rules. Easy to manage with tags. |

| Dynamic Discount | Offers change based on behavior – like frequency, cart value, or loyalty. Keeps deals feeling fresh. |

| Demand-Based | Prices go up when demand spikes, and down when it drops. Helps with stock control and urgency. |

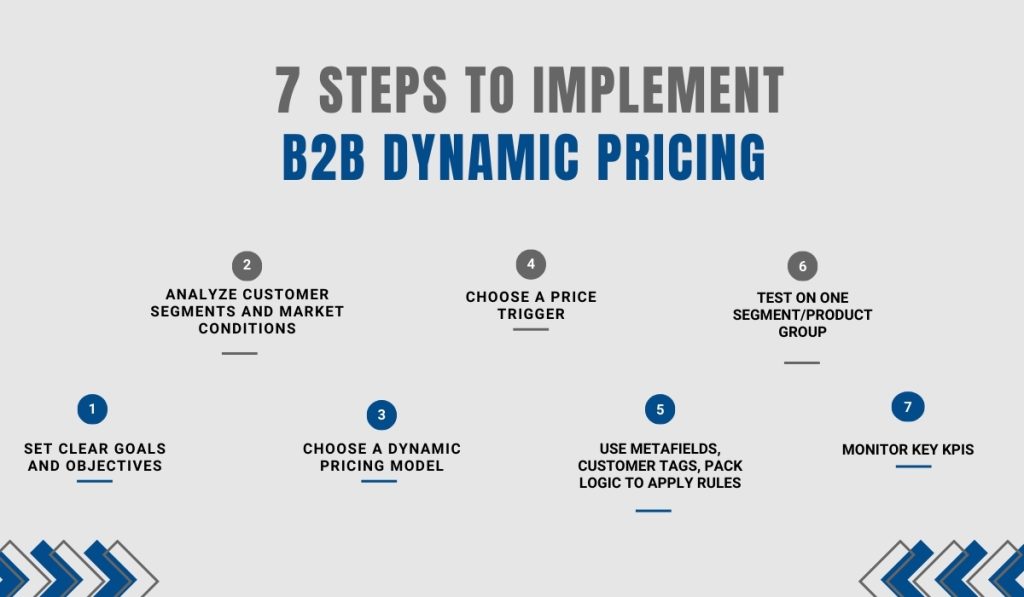

How To Implement B2B Dynamic Pricing On Shopify in Just 7 Steps

It isn’t just for tech giants. If you’re a B2B merchant on Shopify, you can use it to respond faster, price smarter, and stay profitable. But to make it work, you need a clear process. Here’s how to do it — step by step.

- Set Clear Goals and Objectives

- Analyze Customer Segments and Market Conditions

- Choose a Dynamic Pricing Model

- Choose a Price Trigger

- Use Metafields, Customer Tags, and Pack Logic to Apply Rules

- Test on One Segment/Product Group

- Monitor Key KPIs

Step#1 Set Clear Goals and Objectives

Define what you want: maximize profit margin, grow market share, or win back deals from competitors. Each goal changes how you price. Before you touch any pricing rule, be honest about what you’re trying to fix.

- If you’re focused on profit, build rules that protect your margins.

- If you want volume, offer better prices for bigger orders.

- If you care about fairness, make sure different customer types get what fits them.

The goal decides the pricing logic. So don’t skip this.

Step#2 Analyze Customer Segments and Market Conditions

Look at your buyer types. Do you serve wholesalers, resellers, or repeat buyers? Do their needs differ?

Also, check your market: how often do costs (raw materials or shipping) shift? If prices bounce around, static pricing hurts margins.

This analysis sets the stage for whether it is right and how granular your pricing model should be.

- Group customers: wholesalers, retailers, resellers, bulk buyers.

- Look at behaviors: who buys often, who negotiates, who cares about speed?

- Watch the market: Are your costs stable? Is competition undercutting you?

Step#3 Choose a Pricing Model

Pick models that suit your needs: quantity-based, time-based, customer segment-based, or demand-driven. For example, if order volumes vary, quantity-based pricing makes sense. If demand spikes seasonally, time-based pricing helps.

Don’t force one-size-fits-all. Build a hybrid model that matches your goals and store behavior.

Step#4 Choose a Price Trigger

Price triggers are the “if this, then that” of your pricing rules. Select triggers that drive automation. For instance, set a rule: 10% off if the order is>100 units. Or raise the price 5% when stock drops below a threshold. These triggers form the backbone of your automation.

Common triggers:

- Order volume

- Cart value

- Customer tags (e.g., B2B, reseller)

- Inventory level

- Time of day or day of the week

- Location

Step#5 Use Metafields, Customer Tags, and Pack Logic to Apply Rules

Shopify lets you store custom data using metafields and customer tags. These are gold for B2B pricing.

For example:

- Use tags to group customers by type or contract

- Store price tiers in metafields for each product variant

- Apply logic for pack sizes or bundle quantities

This structure lets you apply dynamic rules without breaking your store layout. And once set up, you can adjust rules without touching every product manually.

Step#6 Test on One Segment/Product Group

Don’t roll this out store-wide just yet. Choose a product category or a specific customer group. Set up one dynamic pricing rule and track what happens.

Watch:

- Do buyers respond well to the price shift?

- Are support tickets or refund rates going up?

- Are you hitting your margin or conversion goals?

Testing helps you find mistakes before scaling.

Step#7 Monitor Key KPIs

Track metrics and collect feedback. Align teams across sales, finance, and data to track progress. Review your pricing logic regularly.

Watch:

- Margin percentage – Are you making more?

- Conversion rate – Are buyers still checking out?

- Refund rate – Are price changes confusing people?

- Customer feedback – Any pushback or pricing concerns?

How AI Optimizes Pricing Models

AI takes pricing from guesswork to wise decisions. Instead of adjusting prices manually, AI tools use real data, like past orders, browsing behavior, and market changes. Then suggest the best price at the right time.

For B2B, this means your prices can respond to real patterns. Say a particular product always spikes in demand mid-month. Or a loyal buyer usually orders extra before a holiday. AI spots these habits and adjusts prices accordingly.

Machine learning can also help predict demand. If your raw material costs are rising or a competitor drops their price, your system can respond in real-time, without you lifting a finger.

On Shopify, AI-driven pricing can pull in customer tags, order volume, and inventory levels to make smarter decisions. Over time, it learns what works and keeps improving.

This isn’t just about automation. It’s about offering better prices to the right customers while protecting your margins. Predictive analytics gives you the edge, especially in fast-moving B2B markets.

Buyer Psychology: When Dynamic Pricing Backfires

B2B buyers don’t just look at the final number; they compare. They track past invoices. They ask around. If your pricing feels inconsistent, you risk losing trust.

Dynamic pricing can backfire when changes aren’t transparent or fair. If a loyal customer sees a higher price than before, they might ask:

“Why was I charged more this time?”

Or worse, “Did my colleague get a better deal?”

That kind of doubt breaks relationships fast.

To avoid this, anchor your pricing. Show the “last order price” or note what changed, like raw material costs or order size. For big accounts, lock in rates when possible. It shows respect and builds stability.

Also, make sure your team can explain how pricing works. A short, honest conversation goes a long way. It’s not about hiding your strategy. It’s about helping customers understand it.

It should feel like a benefit, not a surprise. If buyers know what to expect, they’re more likely to trust the change.

Common Pitfalls and Easy Fixes

Dynamic pricing can boost profits, but common mistakes can hurt results. One significant error is over-relying on algorithms without human oversight. It leads to absurd prices that drive customers away. Another pitfall is ignoring competitor pricing. It will cause your offers to become uncompetitive. Additionally, failing to segment customers means missing out on personalized deals that increase conversions.

Quick fixes are available. First, monitor competitor prices in real-time and adjust accordingly. Second, set price floors and ceilings to avoid extreme fluctuations. Third, use customer data to tailor discounts for loyal buyers.

Suppose a SaaS company notices a drop in sign-ups. They can offer limited-time discounts for first-time users to revive sales. Minor, data-backed adjustments prevent revenue leaks while keeping customers happy.

The Future of Dynamic Pricing

The future of dynamic pricing is evolving rapidly, powered by AI-driven automation and hyper-personalization. Future strategies will leverage real-time demand forecasting, adjusting prices instantly based on buyer behavior. B2B pricing will become more sophisticated, with automated workflows setting optimal rates for bulk purchases or contract renewals.

Personalized pricing for specific customer types, loyal clients may see exclusive discounts, while high-intent buyers get dynamic offers. AI tools will also predict market shifts, helping businesses stay ahead. The future is not just about algorithms. It’s about smarter, customer-centric pricing that maximizes value for both brands and buyers.

Final Thought

Dynamic pricing isn’t just for big players. If you run a B2B store on Shopify, it’s a practical way to stay flexible, protect your margins, and better serve each customer.

Don’t overthink it. Start with one segment or product group. Set a clear rule and watch what happens. You’ll learn fast – what works, what needs adjusting, and how your buyers respond. From there, build smarter pricing step by step. Test, improve, and repeat.

The sooner you begin, the sooner your pricing starts working for you, not against you. So, start small today and grow your strategy from real results.

Dynamic Pricing for Shopify B2B Merchants FAQ

What is dynamic pricing in B2B?

It’s a pricing method where prices change based on things like order volume, customer type, stock levels, or market shifts. Instead of one fixed price for everyone, you create rules so pricing fits each situation.

What is an example of dynamic pricing in business?

Say you sell bulk office supplies. You might give wholesalers 20% off if they order 1,000 units. Or change prices based on how much stock is left. That’s dynamic pricing in action.

How does dynamic pricing affect customers?

If done right, it feels fair. Big buyers get better deals. Long-term clients see loyalty rewards. But if it’s unclear or inconsistent, it can cause confusion or frustration.

What is the main benefit of dynamic pricing?

You stay flexible. It helps you protect margins, move stock smarter, and give each customer the price that fits them best.