For any business, generating revenue is crucial for survival and growth. Revenue is even more important for B2B ecommerce stores. The ecommerce business will keep growing and to be a successful B2B business your business needs to stand out. Among many Shopify startup stores, many common Shopify mistakes are made causing the business to fail. One of these mistakes is mismanagement of cash flow.

According to Business Insider, 82% of startups experience cash flow problems which directly results in a startup failing within the first five years. Cash flow issues usually start at improper inventory levels and businesses not understanding how to manage them.

So in this article, I will highlight the relationship between cash flow and inventory control in a B2B business. I will go over exactly how inventory management reduces cash flow and the strategies that your business can apply to retain a positive cash flow.

Explaining Cash Flow And Different Types Of Cash Flow

Before I explain the relationship between cash flow and inventory control, let’s briefly go over what cash flow is.

As the name suggests, cash flow is the movement of cash through your business. It is the lifeblood of the company. From being able to manage day-to-day operations to generating income, cash flow is the key to all of that. It helps keep track of the financial health of your business and determines whether your business can grow or not.

It can be divided into two parts: income and expenditure. Income is the money that is coming into your business. Income can be from selling products or services to other B2B businesses. Meanwhile, expenditures are the money going out of your business. There are various expenses that a business can incur. For example, rent, salary payment, and buying goods to sell are all part of the expenses for a B2B business.

Therefore, for a business to have a positive cash flow, income needs to exceed expenses. There are also different types of cash flow. These are:

- Cash flows from operations (CFO): Flow of cash from regular business operations. It is calculated as:

💸CFO = Net Revenue from Sales – Operating Expenses

- Cash flows from investing (CFI): The flow of cash that is obtained from investments. It is calculated as:

💸CFI = Revenue from Investments – Capital Expenses

- Cash flows from financing (CFF): Cash flow that comes from financing like equity, insurance payments, dividends, paying off debts, etc. It is calculated as:

💸 CFF = Cash inflows from issuing equity or debt – (Cash paid dividends + Repurchase of debt and equity)

Relationship Between Cash Flow And Inventory Control

If cash flow is the blood of a business, then inventory is the major component of that blood. Through your B2B inventory, you can generate cash flow for your business. To help generate the cash flow, inventory control is needed. Essentially, inventory control is knowing the amounts of the goods and managing them to have the right amount of products to sell.

So what is the relationship between cash flow and inventory control in a B2B business? Your business’s inventory is your income. But to get that inventory, you need to buy it first. That is the basic relationship between cash flow and inventory.

In terms of cash flow, inventory control is a large part of the expenditure. Inventory control can total almost 30% of the carrying cost for a business according to Investopedia. This is a large enough portion of expenditure that can determine whether your business has a healthy cash flow or not.

For example, let’s say you are a t-shirt wholesaler for another B2B business. You bought 100 T-shirts at $15 per and you are planning to sell them for $20 apiece. However, the demand for T-shirts is only at 70. Therefore, you are left with 70 unsold. You will have to hold the extra T-shirts until they can be sold. The carrying cost of those 30 T-shirts is an extra cost for your business. Over time, this results in a negative cash flow as you are unable to sell the T-shirts to generate revenue.

As you can see, cash flow and inventory control have a unique relationship. In the following sections, I will share some inventory control strategies and cash flow tips to help your B2B business flourish.

10 Inventory Control Strategies For Positive Cash Flow

Inventory control strategies are a great way to achieve a positive cash flow for your business. So here are some strategies that you can implement for your B2B business:

Strategy #1 ABC Analysis

ABC analysis is an inventory control method where you categorize your inventory in terms of importance. You can categorize your most important products so you can sell them as quickly as possible. In addition, you can also make sure that you have the right amount of the important inventory so you can meet the demands of your customers. With ABC analysis, you can ensure you are selling the right product and generating a positive cash flow.

With ABC analysis, you also reduce costs for your business. You are stocking the right products and don’t have to deal with holding unnecessary inventory. This will further help your business produce a positive cash flow.

Strategy #2 Bundling Products Together

With ABC analysis, you can identify which of your products are selling well and which aren’t. To help the goods that aren’t selling well, you can bundle products together. Bundling two such products will help increase the average order value for your business. It will also help clear out inventory for products that remain on your store shelves or warehouse. With the sale, you ensure your business’s cash flow increases as well.

Strategy #3 Economic Order Quantity

Economic order quantity (EOQ) is the inventory control strategy where you have the right amount of inventory to sell to help reduce costs like ordering, receiving, and holding inventory. In return, you reduce costs and gain positive cash flow for your business.

Strategy #4 FIFO And LIFO

First-in/First-Out (FIFO) and Last-In/First-Out are great ways to manage your inventory while also helping keep a healthy cash flow. FIFO/LIFO is especially good if your business deals with inventory with expiry dates. You can set your business up so that you sell the goods as soon as they come to reduce the time spent holding inventory.

Not only that, but your customers will also appreciate that they are getting the products in good condition and have a longer shelf-life. Additionally, FIFO means you don’t have to deal with getting rid of the product. It decreases the cost of waste management and stops incurring additional costs for your business.

Strategy #5 Just-In-Time Inventory

Another great inventory control strategy is just-in-time (JIT) inventory. JIT is where you only purchase goods when you want to sell them. For your business, this is great because you don’t have to deal with holding inventory. You only order when you need them and then sell them to your customers. With the right suppliers, JIT is a game changer for your business to generate more revenue and reduce inventory costs.

Strategy #6 Implementing MOQ With A Bulk Order App

Minimum order quantity or MOQ is a great way to ensure positive cash flow for your Shopify store. With an MOQ on your store, you can set a minimum amount of products that a customer needs to buy before the customer can make the purchase.

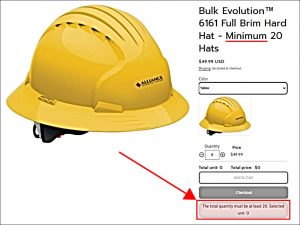

Let’s take a look at a Shopify store that has a MOQ restriction using a bulk order app:

As you can, with this bulk order app, customers need to add 20 hard hats before they are allowed to add to cart. This app both helps your business implement MOQ and makes bulk ordering easier for your customers. Your customers will appreciate the easier purchasing option and are more likely to go through with the purchase. Not only that but your business benefits from increased cash flow. With an app like this, you can manage inventory, bulk ordering, and increased cash flow all in one place.

Strategy #7 Maintaining Stock Levels

Running low on inventory can be a headache for B2B business owners. That is why it is important to maintain stock levels with reorder points when your inventory stock levels reach a certain level.

You can do this with the help of inventory management software which keeps real-time track of your inventory. When stock levels are low, it can notify you that you need to reorder to maintain your inventory. For example, if your stock levels reach below 20% of the total inventory of the product, you can set up a reorder point to get back to optimal stock levels.

This will help improve your cash flow because you are only reordering when it is needed and not over-purchasing on inventory. It improves inventory efficiency and reduces the costs of holding too much or too little inventory.

Strategy #8 Vendor-Managed Inventory (VMI)

If you are worried about costs related to holding inventory, then a vendor-managed inventory system might benefit your B2B business. Essentially, you are allowing your vendor to manage inventory for your business. This allows you to focus on other business aspects such as branding for B2B ecommerce.

With VMI, you retain ownership of your inventory and your vendor restocks goods for you. This helps with cash flow because you don’t have to deal with inventory management. With the right vendor, this will significantly improve your cash flow and make your business grow.

Strategy #9 Delayed Payments With Inventory Consignment

Inventory consignment with a vendor is another great way to manage your inventory while keeping cash flow in mind. In a consignment agreement, you get the inventory from your supplier and have to manage it. But you pay the supplier after the inventory is sold.

In an inventory consignment agreement, the supplier bears the risk of unsold inventory. You can return any unsold inventory because the supplier has ownership of it. But if you do sell it, you get a percentage of the sale as revenue. It’s great for startup companies because you don’t have to pay for inventory upfront and can delay payment. Inventory consignment helps small businesses during the dreaded first years of business and not worrying about cash flow issues.

Strategy #10 Dropshipping Your Products

If you want to eliminate inventory costs, then dropshipping your products is a great strategy. Your customers pay you the price that you have set for the product and then you pay the supplier to deliver the product to the customer. You retain the profits for the product which in turn increases your cash flow. Along with that, you don’t have to worry about any inventory risk as the supplier is the one handling the inventory.

8 Cash Flow Tips To Unlock Your Inventory Control Potential

Cash flow, especially for small businesses, is crucial for survival. Semrush found that 66% of small business owners face financial challenges due to cash flow problems. To help with that, here are some tips that can help increase your cash flow by unlocking your inventory control potential.

Tip #1 Monitor Your Cash Flow Regularly

Monitoring your cash flow regularly is vital for inventory control. With proper cash flow analysis, you can keep track of your inventory. For example, you can match your income and expense statements to ensure that you are not missing inventory. This will help both control your inventory and know if there are problems in your inventory management.

Tip #2 Cut Unnecessary Inventory Costs

43% of businesses do not track their inventory according to Zippia. This is a big concern for your business because if you don’t know how much inventory you are holding, then you risk increasing unnecessary costs for your business. That is why you should monitor your inventory so you cut unnecessary products like defective goods. This reduces costs and improves your cash flow.

Tip #3 Utilizing Unused Assets

A major reason that businesses run into negative cash flow is due to unused assets. This could be equipment that is not in use which does not benefit your inventory management. Instead, you can rent out these unused assets and open a new revenue stream for your business. With this, you don’t have to worry about inventory holding costs and increase cash flow into your business.

Tip #4 Renting Equipment When Possible

Technology is advancing so quickly that the equipment you had last year might become inefficient the next. That is why you should rent equipment if possible. It keeps the costs low and gives your business the ability to switch to newer equipment easily. With improved efficiency, you can generate more revenue and have a positive cash flow.

Tip #5 Streamlining Invoicing

Invoices are a great way to keep track of purchases made. With a streamlined invoicing system, you can ensure that your customers are getting the right amount of product and you are getting the money for it. This helps to both keep track of your inventory and keep a healthy cash flow for your business.

Tip #6 Ordering In Bulk

Large orders are great for B2B businesses. Your business can order a large amount at lower prices which reduces costs. In addition, you will have safety stock with large orders so you don’t have to worry when inventory is running low.

Tip #7 Long-Term Contracts

Vendors and suppliers are the ones that are giving you the inventory to sell. That is why it is important to establish a strong vendor relationship. Your business can do this with the help of long-term contracts with vendors. You can set expectations with the vendors and negotiate lower prices. With this, your cash flow will remain steady over a longer period and you have the right amount of inventory needed to sustain positive cash flow.

Tip #8 Improve Cash Flow Forecasting

Cash flow forecasting is key to inventory management. With the proper analysis, you can buy the right amount of product for your business to sell. This reduces the chances of unsold inventory which in turn reduces holding costs. So for your business, make sure you analyze the market and forecast how much inventory you need to buy. With more accurate forecasting, you gain a better understanding of the market and keep a healthy cash flow for your B2B business.

Bottom Line

Understanding the relationship between cash flow and inventory control in a B2B business is important for survival in the ecommerce market. You want to reduce inventory costs while maintaining a healthy cash flow. With the inventory strategies and cash flow tips I have mentioned, your B2B Shopify store can be set up for success.